The BT Group recently unveiled their H1 FY24 results, covering performance up to September 2023. The report highlights the remarkable expansion of Openreach’s full fibre (FTTP) broadband ISP network, showcasing significant gains in premises coverage. Furthermore, it outlines BT Group’s progress in the 5G domain, along with key financial insights.

Here are the key highlights of the report:

Openreach’s FTTP Expansion

Openreach, a subsidiary of BT Group, has been making substantial strides in extending its FTTP broadband network. In the last quarter, Openreach added a record 860,000 premises to its coverage, a notable increase from the 718,000 in the previous quarter. Currently, the FTTP network reaches an impressive 11.85 million premises, with an additional 6 million undergoing the initial build process.

The success of Openreach’s FTTP rollout reflects a remarkable average build rate of 66,000 premises per week, emphasizing their commitment to investment. The company has earmarked £15 billion for expanding its network, with the aim of reaching 25 million premises in the UK by December 2026. A significant portion of this expansion, around 6.2 million premises, is planned for rural and semi-rural areas, underlining Openreach’s commitment to bridging the digital divide.

BT Group’s Customer Insights

While BT Group’s retail divisions, which include BT, EE, and Plusnet, do not disclose specific customer figures for their ISP products, they do provide data on “ultrafast broadband” (100Mbps+) plans and mobile services.

The report reveals that BT Group now has 2.08 million FTTP customers, a notable increase from the 1.745 million in FY23. In addition, EE’s 5G connections have surged to 8.953 million, up from 7.774 million in the previous fiscal year. This growth in customer numbers aligns with the increasing consumer demand for high-speed internet and connectivity.

On average, BT Group’s consumers now consume 389 gigabytes (GB) of data per month, up from 364.6GB, indicating a growing appetite for data-intensive applications and content.

Network Coverage and Take-up

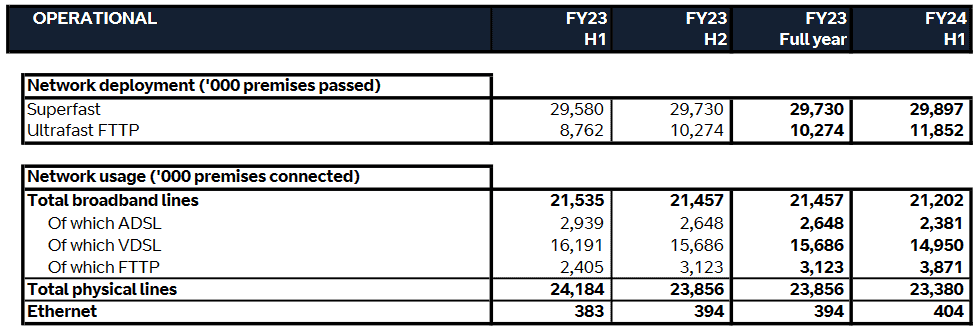

The following table illustrates the distribution of fixed-line network coverage and take-up across various technologies on Openreach’s UK network, covering all ISPs that utilise their services.

Openreach-FY24-H1-network-coverage-and-takeup

As seen in the table, Openreach’s FTTP network continues to expand rapidly, with 860,000 additional premises added in the latest quarter, resulting in a total of 3.871 million FTTP broadband connections on Openreach’s network. This impressive growth in take-up, reaching 33%, highlights Openreach’s ability to attract customers despite stiff competition from rival networks.

Notably, Openreach no longer reports statistics for their hybrid fibre G.fast network, indicating a shift in focus towards more advanced technologies. However, they continue to provide data for ADSL and VDSL (FTTC), albeit without mention of G.fast.

Financial Highlights

BT Group’s financial performance for the H1 FY24 period reflects a robust business operation. Key financial figures are as follows:

- BT Group revenue: £10,414 million, up from £10,301 million in H2 FY23.

- BT Group total reported net debt: £(19,689) million, increased from £(18,859) million.

- BT Group profit after tax: £844 million, down from £1,012 million.

CEO Philip Jansen’s Remarks

Philip Jansen, CEO of BT Group, expressed his satisfaction with the results, emphasizing the company’s commitment to its strategic goals. He highlighted BT Group’s strong position in the market, driven by their next-generation networks, streamlined product offerings, and consistent revenue and EBITDA growth.

“BT Group’s transformation program has resulted in £2.5 billion in annualised savings, well on track to meet our £3 billion savings target by FY25” added Jansen.

Looking ahead, Jansen expressed optimism about BT Group’s future and the leadership transition, with Allison Kirkby set to take the reins early in the new year.

Progress Toward Strategic Metrics

BT Group’s commitment to strategic targets remains unwavering. The report provided updates on several key metrics:

- Total labour resource decreased to 123,000, on track for the target range of 75,000 to 90,000 by 2030.

- FTTP premises passed increased to 11.9 million, aligning with the goal of 25-30 million premises by 2030.

- Openreach’s FTTP take-up rate rose to 33%, progressing towards the target range of 40-55%.

- 5G UK population coverage expanded to 72%, with retail connections reaching 9.9 million, on course for the target of 13.0-14.5 million.

In summary, BT Group’s H1 FY24 results demonstrate significant growth in Openreach’s FTTP network, reflecting the surging demand for high-speed broadband services. The company’s commitment to achieving strategic goals and maintaining strong financial performance underscores its position as a key player in the telecom industry.

Please note that BT Group now publishes detailed results biannually for H1 and H2, limiting the availability of quarterly data. These reports offer a comprehensive view of the company’s performance and strategic progress.